Where Should you Retire?

LifestyleReviewsTop Five September 10, 2020 Kristian Wilson

Deciding where you should retire is always a top concern for many seniors. It may be something you start to consider early on in your life. If you don’t plan to live in your current city or state, you may need to start planning early and consider where your hard-earned dollars, and that retirement plan, will last the longest.

The United States has many great places to call home that are especially nice for senior citizens. Some of the best places to consider:

Virginia

In the first place, you should look for the best senior independent living in the great state of Virginia. Virginia has many of the features that you need to live a great life as a retiree. First, it is tax-friendly for all retirees. Since the tax rate, you fall in will greatly determine how long your retirement lasts, this is a good thing. In this state, all Social Security income will not be taxed, along with all earned income less than $12,000. The property tax rate is only 1% and the maximum sales tax is 6%. You can purchase groceries with only 2.5% tax too.

Virginia also has communities for every level of income. While the average cost of living here is 9.4% above the national average, if you live outside of the cities, you can get a much more affordable rate. There are plenty of nice areas, including Roanoke and Richmond, that is much better to live in without the high price.

Medical care is very easy to access in this state. Even though Virginia is not as large as many other states, it can boast 89 premier hospitals, making it one of the best places for your medical care. There is an astounding 127 primary care physicians for every 10,000 residents, which is higher than any other state.

The main drawback is the weather during the winter. Virginia is generally really nice, with the beautiful Appalachian Mountains to enjoy and look at any time, and plenty of great forestry and scenery to help you keep moving and getting stuff done during the day. But thanks to the mountains, the winters can get a little snowy and cold.

Nebraska

Nebraska is another place to look when you are considering where you should retire. This state may not be the first one on your list when you start, but it will provide you with a lot of great features. First, it has the affordability you need. Nearly 3000 retirement-aged adults moved to Nebraska in 2017. While this is lower than other states like Florida and Arizona, the cost of living in Nebraska is much lower, making it an appealing choice. While this state doesn’t exempt your Social Security benefits, it does have lower costs in other places, such as lower home prices and lower state tax.

Nebraska also has some great medical facilities you are sure to enjoy. Residents in this state get some great health care networks, including Nebraska Medicine in the Omaha area and Bryan Health in the Lincoln area. There are many other great hospitals and care centers throughout the states to keep you healthy.

The weather is pretty mild most of the year in Nebraska. And there is a lot of history to explore along with beautiful trails, nature, and more. The winters can get a little bit colder here and may be severe enough to drive a few seniors away. However, most of the year is nice and the winter storms are nowhere near as bad as some of the locations up north.

Florida

Florida is one of the top places to retire for seniors. It has pretty much everything that you would want in your retirement, from no taxes to great weather and some of the best health care systems in the country. The first thing that draws retirees here is the nice weather. Florida has gorgeous weather all year long. While you may have to deal with some rain many days of the year, it doesn’t last for long and then you get the sun back to help you enjoy the day.

The taxes are also appealing. Florida has low taxes, including no state income tax, no estate tax, and no inheritance tax. This is a big deal when you are retiring and on a fixed income. This helps to stretch your money even further. Florida also has a lower cost of living compared to other states. It is cheaper to get a nice home and get the medical attention that you need, Plus, there are a ton of attractions and things to see and do right in your backyard so traveling is not as expensive.

Healthcare is also great here. Since so many retirees head south when they are ready to take a break from work, there are plenty of options for finding the right medical professionals for you. There is the Mayo Clinic in Jacksonville, the Florida Hospital in Orlando, and the Moffit Cancer Center in Tampa so you are sure to find the medical attention you need.

This state also has a wide range of adult active communities. If you would like to keep busy and meet others, there are a lot of options out there. All of the Active Adult Communities also have services and amenities that are sure to attract your attention. Getting some of the socialization you need and all that good sunshine will help you to stay healthy and happy in retirement.

Arizona

If you want a fun place to retire with a lot of great outdoor activities, then Arizona may be the place for you. It has the Grand Canyon along with many other historical locations that will get you up and moving all day long. Learn a little bit of history to keep the mind sharp, while having fun being active at the same time.

The Weather in Arizona is also amazing. The winter temperatures found in this state are like the summer temperatures found in the southeast, but you won’t have to worry about the humidity. The rainfall will vary based on where you live with up to 30 inches a year in the mountains, but less than three in the dessert. Most cities will enjoy more than 250 days of sun each year so this is perfect if you want something that will keep you happy all year long.

The taxes are also affordable here, which is important while you are on a fixed income. Arizona does not tax your social security income so that will help stretch your money a little further. In addition, there are no estate taxes, gift taxes, or inheritance taxes and the state tax is nice and low as well.

Thanks to the great weather and low taxes, many retirees are going to Arizona to help them live a good life. This also means that there are plenty of amazing doctors and hospitals to love too. Medical facilities are found throughout the state, with some of the best in the country found in Pheonix. You are sure to find all the medical attention and the best doctors for all your needs.

Finding a good place to retire is so important. You have spent a lot of your time saving and preparing so you can enjoy the later years of your life. You want to pick a comfortable place, doesn’t cost too much, has nice weather, will give you plenty to do and has some good medical facilities to help you when you get sick. Virginia, Nebraska, Florida, and Arizona are some of the best places to retire in the United States and are options you should check out while planning your retirement.

Related Posts

Review: Medical Alert Systems

If you have been looking into buying a medical alert system, our team has put together a quick review on the leading options: How Medical Alert Systems work: Nearly all medical alert systems for seniors have a button that can be pushed if they are experiencing a medical emergency, fall…

Searching for the Best Hearing Aids?

When you can’t hear, it’s miserable. Don’t let that loss dictate your life and lifestyle! Try out some of the top hearing aids and see how new technology can help you get back into the conversation! The 3 Best Brands Accolades Best Overall Best Design Best Connectivity Bluetooth Yes Yes…

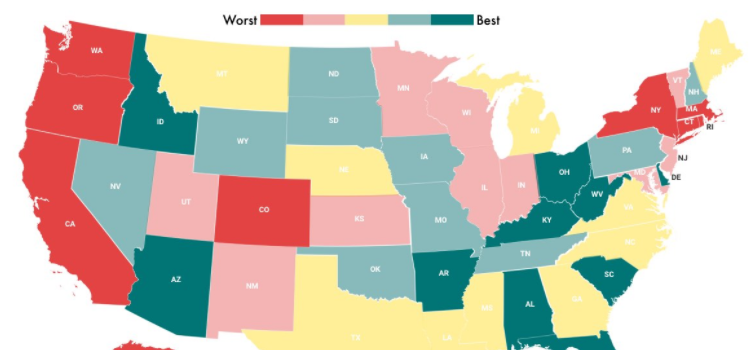

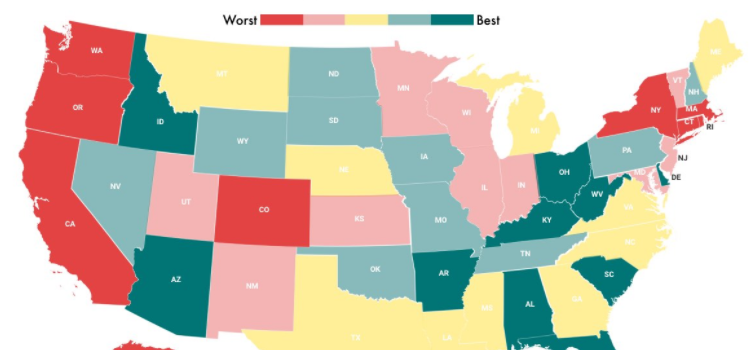

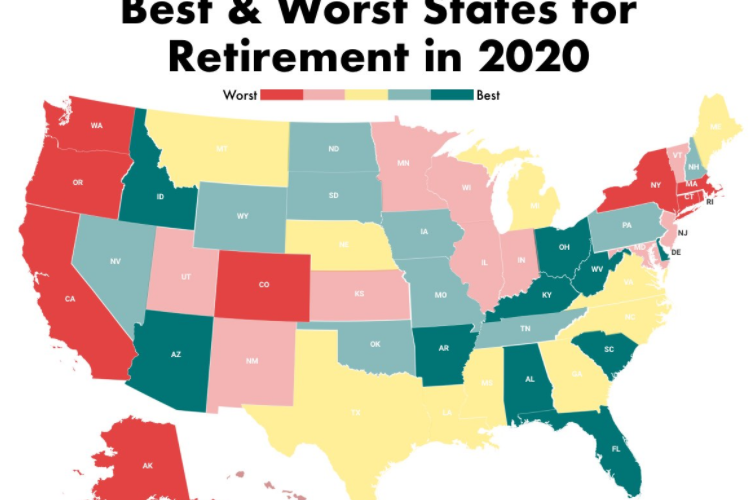

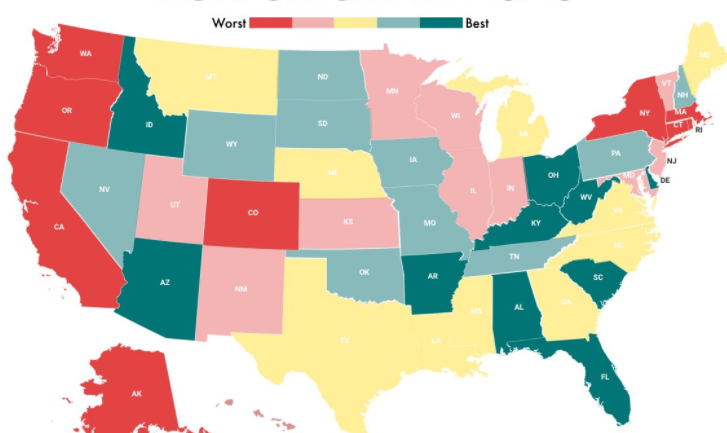

Best States for Senior Independent Living

Thinking about Senior Independent Living? We’ve put together the top 10 best and worst states for retirement and Senior Living. Related Posts